Why You Need To Think About an Offshore Depend On for Safeguarding Your Possessions and Future Generations

If you're looking to secure your wide range and ensure it lasts for future generations, thinking about an overseas depend on could be a smart step. As you explore the potential of offshore counts on, you'll find exactly how they can be customized to fit your details demands and objectives.

Understanding Offshore Depends On: What They Are and Just How They Work

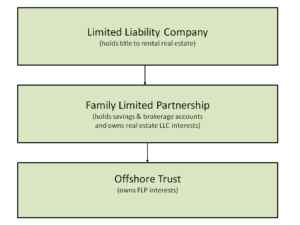

When you assume concerning guarding your assets, offshore trusts might come to mind as a practical option. An overseas trust fund is a lawful setup where you move your possessions to a trustee located in one more nation.

The secret parts of an offshore trust fund consist of the settlor (you), the trustee, and the recipients. You can customize the trust to your requirements, defining how and when the assets are distributed. Considering that these trust funds often operate under desirable legislations in their jurisdictions, they can supply improved personal privacy and security for your wide range. Comprehending exactly how offshore trusts feature is vital before you decide whether they're the appropriate choice for your property security approach.

Advantages of Developing an Offshore Trust

Why should you think about developing an offshore depend on? Furthermore, offshore trusts use flexibility pertaining to asset monitoring (Offshore Trusts).

Another trick benefit is privacy. Offshore counts on can give a greater level of discretion, securing your financial events from public scrutiny. This can be essential for those wishing to maintain their wide range discreet. Additionally, establishing an offshore count on can advertise generational riches preservation. It permits you to set terms for just how your properties are distributed, ensuring they profit your future generations. Eventually, an overseas depend on can function as a strategic tool for securing your monetary tradition.

Safeguarding Your Properties From Legal Cases and Financial Institutions

Developing an offshore trust fund not only supplies tax advantages and privacy yet also acts as an effective shield against legal claims and creditors. When you put your possessions in an overseas depend on, they're no more thought about component of your individual estate, making it a lot harder for lenders to access them. This separation can protect your wide range from lawsuits and claims developing from organization conflicts or personal obligations.

With the ideal territory, your assets can profit from rigid privacy regulations that discourage financial institutions from seeking your wide range. Furthermore, numerous overseas counts on are developed to be testing to permeate, usually requiring court activity in the depend on's territory, which can serve as a deterrent.

Tax Obligation Efficiency: Minimizing Tax Obligation Obligations With Offshore Counts On

Furthermore, because trust funds are typically strained differently than individuals, you can gain from reduced tax obligation prices. It's crucial, nonetheless, to structure your trust appropriately to ensure conformity with both residential and worldwide tax obligation legislations. Dealing with a certified tax obligation consultant can assist you browse these complexities.

Ensuring Privacy and Confidentiality for Your Wealth

When it pertains to securing your wide range, assuring personal privacy and confidentiality is vital in today's progressively clear economic landscape. An overseas count on can offer a layer of safety and security that's hard to attain via domestic alternatives. By positioning your possessions in an overseas territory, you secure your monetary info from public examination and reduce the risk of undesirable focus.

These counts on frequently come with stringent privacy laws that avoid unauthorized access to your economic information. This implies you can protect your riches while keeping your tranquility of mind. You'll likewise restrict the possibility of lawful conflicts, as the information of your trust fund stay personal.

In addition, having an offshore trust fund means your properties are much less vulnerable to personal obligation claims or unforeseen monetary crises. It's an aggressive step you can take to ensure your monetary tradition stays intact and exclusive for future generations. Rely on learn this here now an overseas framework to guard your wealth effectively.

Control Over Property Distribution and Monitoring

Control over property distribution and management is among the vital advantages of setting up an overseas count on. By establishing this count on, you can determine just how and when your possessions are dispersed to beneficiaries. You're not simply see this here handing over your riches; you're setting terms that show your vision for your legacy.

You can establish specific conditions for circulations, guaranteeing that beneficiaries satisfy specific criteria before obtaining their share. This control helps stop mismanagement and assurances your assets are utilized in ways you regard suitable.

Additionally, appointing a trustee allows you to hand over administration duties while keeping oversight. You can select somebody who lines up with your worths and comprehends your goals, assuring your possessions are taken care of intelligently.

With an overseas trust fund, you're not only safeguarding your wealth but likewise forming the future of your recipients, giving them with the support they require while keeping your wanted level of control.

Picking the Right Jurisdiction for Your Offshore Trust Fund

Look for nations with solid lawful frameworks that sustain count on legislations, making certain that your assets continue to be safe from potential future claims. In addition, availability to neighborhood banks and seasoned trustees can make a large difference in managing your depend on efficiently.

It's important to assess the prices included also; some jurisdictions might have greater arrangement or upkeep fees. Eventually, choosing the right jurisdiction suggests aligning your financial objectives and family requires with the particular advantages used by that location - Offshore Trusts. Take your time to research study and talk to experts to make one of the most informed choice

Frequently Asked Questions

What Are the Expenses Related To Establishing an Offshore Count On?

Establishing up an offshore depend on entails various prices, including legal charges, configuration costs, and ongoing maintenance costs. You'll wish to budget plan for these aspects to assure your trust operates efficiently and properly.

Exactly How Can I Discover a Respectable Offshore Depend On Service Provider?

To find a credible offshore depend on supplier, research study online evaluations, ask for referrals, and verify credentials. See to it visit site they're skilled and clear about charges, services, and policies. Depend on your reactions throughout the option process.

Can I Manage My Offshore Trust Fund From Another Location?

Yes, you can handle your overseas trust fund remotely. Several suppliers use on-line accessibility, enabling you to keep track of investments, connect with trustees, and accessibility files from anywhere. Just assure you have safe net access to safeguard your info.

What Happens if I Relocate To a Various Nation?

If you relocate to a different nation, your offshore trust's regulations might alter. You'll require to speak with your trustee and potentially readjust your trust fund's terms to abide with neighborhood laws and tax obligation effects.

Are Offshore Trusts Legal for People of All Nations?

Yes, offshore counts on are legal for citizens of many countries, however regulations differ. It's important to investigate your country's regulations and speak with a lawful specialist to assure conformity and recognize prospective tax obligation effects prior to proceeding.